The BEA has released the Q4 GDP numbers for the economy. They summarize the data as follows:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009,(that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.2 percent.

This is a substantial growth and shows a recovery.

However we want to show a few facts that will be critical in the analysis.

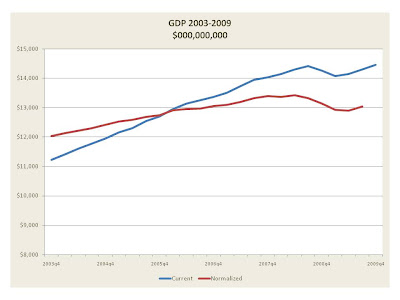

Fact 1: The real GDP has grown but the growth although good places it still on a path below the beginning of the Recession. We demonstrate that with the graph below.

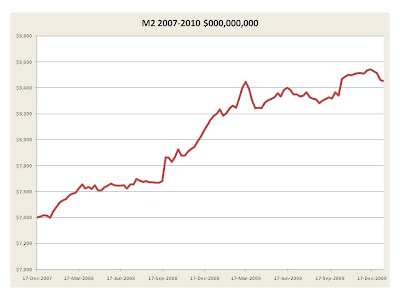

Fact 2: M2 is still flat. Despite the flow of funds from the FED, the supply of money is very stable and this seems to imply a low velocity of money and that people are saving more and spending less. Thus there will be a conservative recovery unless there will be a double dip resulting from loss of faith in what Washington is going to do. Currently the gross uncertainty is a major factor in low spending.

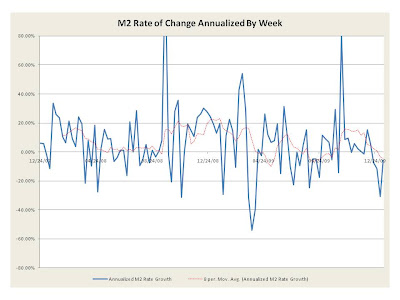

Fact 3: M2 annualized rates of change are again negative or in the negative range. There is little growth in money supply and thus fear of inflation is low but prospects for a growing GDP are also low. The conundrum is somewhat driven by the assumption that people hold money if they believe that its value will not appreciate. We seem to be seeing this phenomenon in action.

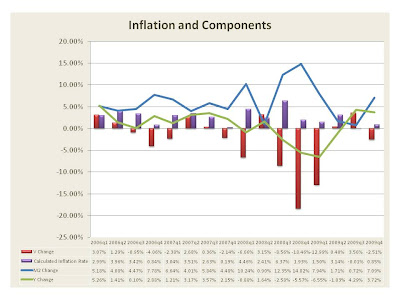

Fact 4: The projected inflation rate based upon the changes in GDP, money velocity, and change in M2 is shown below. Clearly at the current rate inflation is not a concern. Yet we continue to have caution in terms of the FEDs actions, its current excess reserve policy as they explained is really a balance sheet strengthening not a flooding of money supply (See our prior posts on this).

In summary this should be received as good news for the economy. Now if we can reduce inflation. One underlying question however in that we have not yet analyzed the GDP details is what led to this rise. If it were just the Government Spending then we are still concerned.

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009,(that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.2 percent.

This is a substantial growth and shows a recovery.

However we want to show a few facts that will be critical in the analysis.

Fact 1: The real GDP has grown but the growth although good places it still on a path below the beginning of the Recession. We demonstrate that with the graph below.

Fact 2: M2 is still flat. Despite the flow of funds from the FED, the supply of money is very stable and this seems to imply a low velocity of money and that people are saving more and spending less. Thus there will be a conservative recovery unless there will be a double dip resulting from loss of faith in what Washington is going to do. Currently the gross uncertainty is a major factor in low spending.

Fact 3: M2 annualized rates of change are again negative or in the negative range. There is little growth in money supply and thus fear of inflation is low but prospects for a growing GDP are also low. The conundrum is somewhat driven by the assumption that people hold money if they believe that its value will not appreciate. We seem to be seeing this phenomenon in action.

Fact 4: The projected inflation rate based upon the changes in GDP, money velocity, and change in M2 is shown below. Clearly at the current rate inflation is not a concern. Yet we continue to have caution in terms of the FEDs actions, its current excess reserve policy as they explained is really a balance sheet strengthening not a flooding of money supply (See our prior posts on this).

In summary this should be received as good news for the economy. Now if we can reduce inflation. One underlying question however in that we have not yet analyzed the GDP details is what led to this rise. If it were just the Government Spending then we are still concerned.