We have been discussing the excess reserve issue for almost 9 months. Banks are holding massive amounts in excess reserves. The FED has just issued a report to try and calm fears that these reserves are on the one hand not delaying the recovery by not being lent out and on the other hand not being stored up and when let loose create a massive amount of inflation.

The report starts by saying:

"The buildup of reserves in the U.S. banking system during the financial crisis has fueled concerns that the Federal Reserve’s policies may have failed to stimulate the fl ow of credit in the economy: banks, it appears, are amassing funds rather than lending them out. However, a careful examination of the balance sheet effects of central bank actions shows that the high level of reserves is simply a by-product of the Fed’s new lending facilities and asset purchase programs. The total quantity of reserves in the banking system reflects the scale of the Fed’s policy initiatives, but conveys no information about the initiatives’ effects on bank lending or on the economy more broadly."

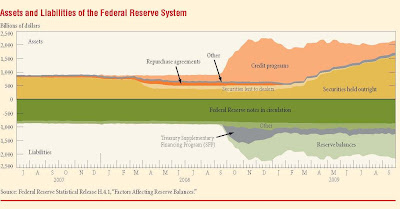

They then show the balance sheet of the FED graphically which we reproduce below:

The above really shows the "junk" that the FED loaded onto its public balance sheet. It fails to show all of the off balance sheet junk as detailed by Prins.

They continue:

"Some commentators see the surge in excess reserves as a troubling development— evidence that banks are hoarding funds rather than lending them out to households, firms, and other banks. Edlin and Jaffee (2009, p. 2), for example, identify the high level of excess reserves as the “problem” behind the continuing credit crunch—or, “if not the problem, one heckuva symptom.” Other observers see the large increase in excess reserves as a sign that many of the steps taken by the Federal Reserve during the crisis have been ineffective. Instead of restoring the fl ow of credit to firms and households, they argue, the money the Fed has lent to banks and other financial intermediaries since September 2008 is sitting idle in banks’ reserve accounts."

They conclude:

"We began this article by asking, Why are banks holding so many excess reserves? We then used a series of simple examples to answer this question in two steps.

First, we showed that the liquidity facilities and other credit programs introduced by the Federal Reserve in response to the crisis have created, as a by-product, a large quantity of reserves in the banking system.

Second, we showed that while the lending decisions and other activities of banks may result in small changes in the level of required reserves, the vast majority of the newly created reserves will end up being held as excess reserves.

The dramatic buildup of excess reserves reflects the large scale of the Federal Reserve’s policy initiatives; it conveys no information about the effects of these initiatives on bank lending or on the level of economic activity.

We also discussed the importance of paying interest on reserves when the level of excess reserves is unusually high, as the Federal Reserve began to do in October 2008. Paying interest on reserves allows a central bank to maintain its influence over market interest rates irrespective of the quantity of reserves in the banking system. The central bank can then scale its policy initiatives according to conditions in the financial sector, while setting its target for the short-term interest rate in response to macroeconomic conditions.

This ability to separate short-term interest rates from the quantity of reserves is particularly important during the recovery from a financial crisis. If inflationary pressures begin to appear while the crisis-related programs are still in place, the central bank can use its interest-on-reserves policy to raise interest rates without necessarily removing all of the newly created reserves."

I still believe that this is necessary but highly risky. It does argue that Bernake should stay since he is balancing these balls. Another FED head would have to relearn this magic and the potential for error would be massive.

The problem is less the Reserves than the FED Balance Sheet. Further it is the off Balance Sheet contingencies which are massive. As we have already noted the talk of inflation becoming a positive policy to manage the debt is growing. That will be deadly to the economy.

This report is worth the reading. It details the views of the FED and that is important. It also shows the downside and it is that potential which is worrisome.

The report starts by saying:

"The buildup of reserves in the U.S. banking system during the financial crisis has fueled concerns that the Federal Reserve’s policies may have failed to stimulate the fl ow of credit in the economy: banks, it appears, are amassing funds rather than lending them out. However, a careful examination of the balance sheet effects of central bank actions shows that the high level of reserves is simply a by-product of the Fed’s new lending facilities and asset purchase programs. The total quantity of reserves in the banking system reflects the scale of the Fed’s policy initiatives, but conveys no information about the initiatives’ effects on bank lending or on the economy more broadly."

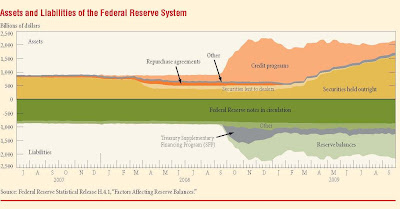

They then show the balance sheet of the FED graphically which we reproduce below:

The above really shows the "junk" that the FED loaded onto its public balance sheet. It fails to show all of the off balance sheet junk as detailed by Prins.

They continue:

"Some commentators see the surge in excess reserves as a troubling development— evidence that banks are hoarding funds rather than lending them out to households, firms, and other banks. Edlin and Jaffee (2009, p. 2), for example, identify the high level of excess reserves as the “problem” behind the continuing credit crunch—or, “if not the problem, one heckuva symptom.” Other observers see the large increase in excess reserves as a sign that many of the steps taken by the Federal Reserve during the crisis have been ineffective. Instead of restoring the fl ow of credit to firms and households, they argue, the money the Fed has lent to banks and other financial intermediaries since September 2008 is sitting idle in banks’ reserve accounts."

They conclude:

"We began this article by asking, Why are banks holding so many excess reserves? We then used a series of simple examples to answer this question in two steps.

First, we showed that the liquidity facilities and other credit programs introduced by the Federal Reserve in response to the crisis have created, as a by-product, a large quantity of reserves in the banking system.

Second, we showed that while the lending decisions and other activities of banks may result in small changes in the level of required reserves, the vast majority of the newly created reserves will end up being held as excess reserves.

The dramatic buildup of excess reserves reflects the large scale of the Federal Reserve’s policy initiatives; it conveys no information about the effects of these initiatives on bank lending or on the level of economic activity.

We also discussed the importance of paying interest on reserves when the level of excess reserves is unusually high, as the Federal Reserve began to do in October 2008. Paying interest on reserves allows a central bank to maintain its influence over market interest rates irrespective of the quantity of reserves in the banking system. The central bank can then scale its policy initiatives according to conditions in the financial sector, while setting its target for the short-term interest rate in response to macroeconomic conditions.

This ability to separate short-term interest rates from the quantity of reserves is particularly important during the recovery from a financial crisis. If inflationary pressures begin to appear while the crisis-related programs are still in place, the central bank can use its interest-on-reserves policy to raise interest rates without necessarily removing all of the newly created reserves."

I still believe that this is necessary but highly risky. It does argue that Bernake should stay since he is balancing these balls. Another FED head would have to relearn this magic and the potential for error would be massive.

The problem is less the Reserves than the FED Balance Sheet. Further it is the off Balance Sheet contingencies which are massive. As we have already noted the talk of inflation becoming a positive policy to manage the debt is growing. That will be deadly to the economy.

This report is worth the reading. It details the views of the FED and that is important. It also shows the downside and it is that potential which is worrisome.