The Figure below shows in the first Figure of the Portfolio value and its return. The drop from Inauguration Day is unrelenting. These are NOT financial stocks. They are core stocks in companies that make what we live on day to day. They are telephone calls, mac and cheese, vanilla wafers, aluminum cans, band aids, drugs. They are core chemicals and the other items which make up or economy.

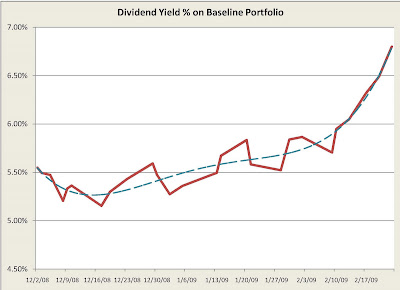

The second is the effective yield curve if we were to purchase this portfolio today and seek only dividends, assuming no change in dividends.

We are seeing a 6.8% dividend yields starting from 5.5% in December. As we have said before the above yields are indicators of future massive inflation and the drops in stock value show that we may readily hit a DOW 6,000 or even lower. Thus we are looking at 20% inflation and a collapsing DOW. And things are very well most likely to get worse!